romacentrarterome.site News

News

Get 100 Until Payday

Your payday can't come soon enough! That's where we come in. You can get a Klover cash advance up to $ cash – even if your payday is 2 weeks away. Payday lenders lure consumes with messages like “Get cash until payday! $ or more fast!” These ads are on the radio, television, the Internet and even in. What are some payday apps I can pull from until the 2nd of next month? I just need to use three to four apps to pull $ or more to pay. (until “payday”), then depositing it or requiring repayment of the loan of $ to $ plus a fee or interest. Small consumer installment loans of $3, or. Most members credit limits start between $$ Limits can increase See how you can get up to $ of your pay before payday, fee-free*. Start. (But be sure to open a new account at a different bank before you close the old account. You may find it more difficult to open a new account once your old one. Your payday can't come soon enough! That's where we come in. You can get a Klover cash advance up to $ cash – even if your payday is 2 weeks away. Home of the 33 minute Loan - Apply. DocuSign. Instant Funding on your debit card. Apply Below and get a loan TODAY! We do not service Pennsylvania. Get a Klover cash advance up to $ cash – even if your payday is 2 weeks away. And unlike banks, there are no late fees, credit checks or interest charges. Your payday can't come soon enough! That's where we come in. You can get a Klover cash advance up to $ cash – even if your payday is 2 weeks away. Payday lenders lure consumes with messages like “Get cash until payday! $ or more fast!” These ads are on the radio, television, the Internet and even in. What are some payday apps I can pull from until the 2nd of next month? I just need to use three to four apps to pull $ or more to pay. (until “payday”), then depositing it or requiring repayment of the loan of $ to $ plus a fee or interest. Small consumer installment loans of $3, or. Most members credit limits start between $$ Limits can increase See how you can get up to $ of your pay before payday, fee-free*. Start. (But be sure to open a new account at a different bank before you close the old account. You may find it more difficult to open a new account once your old one. Your payday can't come soon enough! That's where we come in. You can get a Klover cash advance up to $ cash – even if your payday is 2 weeks away. Home of the 33 minute Loan - Apply. DocuSign. Instant Funding on your debit card. Apply Below and get a loan TODAY! We do not service Pennsylvania. Get a Klover cash advance up to $ cash – even if your payday is 2 weeks away. And unlike banks, there are no late fees, credit checks or interest charges.

When you take a cash advance from EarnIn, you can request up to $ per day, or $ per pay period. Cash advance apps are a popular means for getting quick. Need Cash Before Your Next Paycheck? Options for Getting Money Before Payday · Get access to your paycheck early · Sell used items or services · Increase your pay. The law in South Carolina says that payday lenders can only charge you up to $15 per $ get another loan until it is paid back. If you still owe on. Gerald can send you up to half of your paycheck early. It's your money, so there's no reason you shouldn't have access to it sooner. When your real payday comes. Members are pre-qualified for a cash advance up to $ per pay period, and can get up to another $ with points earned by doing things like watching an ad. It's just a cash advance from the Klover app. You can access up to $ – even if your payday is 2 weeks away. The best part? There is zero interest or late. Check `n Go provides customers with customized financial solutions through installment loans, payday loans, cash advances, & more. Apply today. A dollar payday loan is a short term cash advance you take when you have an urgent need for immediate money. It is an online process and requires no. It's just a cash advance from the Klover app. You can access up to $ – even if your payday is 2 weeks away. The best part? There is zero interest or late. They are not registered to conduct business in Washington State. How safe are online lenders? Before you get a loan from an internet payday lender, make sure. Get a Klover cash advance up to $ cash – even if your payday is 2 weeks away. And unlike banks, there are no late fees, credit checks or interest charges. Get overdraft protection with no mandatory fees or interest payments. *** To illustrate an example, if you were to receive an advance of $ for. EarnIn is an app that gives you access to the pay you've earned - when you want it. Get paid for the hours you've worked without waiting for payday. Chronically taking paycheck advances or payday loans is an easy way to get stuck in a cycle of debt. You might think you only need a little cash until the next. You make your loan request, hit 'submit', and get a reply in less than 90 seconds. You then pay back your loan on your next pay date or within 31 days. PayDaySay stands out as a reliable solution for individuals seeking quick access to funds during financial emergencies to get dollars now. EarnIn lets you get an advance up to $ per pay period, but only up to $ per day. Cost: You can choose to add a voluntary tip when you cash out, and fees. With Empower, you can get an interest-free advance of up to $*. There are no late fees and no credit checks, and you can get your money instantly. Empower. When things come up, apply for an Amscot Cash Advance* and get up to $ cash with no credit checks. Annual Percentage Rate (APR) for the $ cash advance. EarnIn: Best for large cash advances · Loan amount: Up to $ per day and $ per pay period · Speed without paying a fee: business days · Speed with fast-.

Competitive Advantage In Marketing

What are the Seven Main Types of Competitive Advantage? · Cost advantage · Differentiation advantage · Focus Advantage · Speed advantage · Innovation advantage. Definition A competitive advantage exists when there is a match between the distinctive competencies of a firm and the factors critical for success within. A competitive advantage is anything that gives a company an edge over its competitors, helping it attract more customers and grow its market share. "The two basic types of competitive advantage [differentiation and lower cost] combined with the scope of activities for which a firm seeks to achieve them lead. Performing a complete competitive analysis allows businesses to determine their market position and identify opportunities for improvement. By understanding. To gain an advantage, offer things that the competitors don't, especially if they cost very little. Sometimes this may simply involve displaying a list of what. Competitive advantage is what makes a customer choose your business over another one. By understanding, and promoting such advantage, companies can win a. Strategy and Management for Competitive Advantage teaches participants to create strategies and plan business opportunities by evaluating competitors. A competitive advantage is by definition is when a brand uses its assets, its abilities, or its unique features to win out over its competitors. What are the Seven Main Types of Competitive Advantage? · Cost advantage · Differentiation advantage · Focus Advantage · Speed advantage · Innovation advantage. Definition A competitive advantage exists when there is a match between the distinctive competencies of a firm and the factors critical for success within. A competitive advantage is anything that gives a company an edge over its competitors, helping it attract more customers and grow its market share. "The two basic types of competitive advantage [differentiation and lower cost] combined with the scope of activities for which a firm seeks to achieve them lead. Performing a complete competitive analysis allows businesses to determine their market position and identify opportunities for improvement. By understanding. To gain an advantage, offer things that the competitors don't, especially if they cost very little. Sometimes this may simply involve displaying a list of what. Competitive advantage is what makes a customer choose your business over another one. By understanding, and promoting such advantage, companies can win a. Strategy and Management for Competitive Advantage teaches participants to create strategies and plan business opportunities by evaluating competitors. A competitive advantage is by definition is when a brand uses its assets, its abilities, or its unique features to win out over its competitors.

Competitive advantage can also be achieved by offering outstanding customer experiences. Strong marketing and branding, in addition, can increase. In business, a competitive advantage is an attribute that allows an organization to outperform its competitors. A competitive advantage may include access. No competitor must have already proposed it in the market. Remember that the fact that the unique selling proposition is unique, however, is of relative. There can be many types of competitive advantages including the knowledge, skills, structure, product offerings, distribution network, and support. Published in. A competitive advantage enables a company to perform better than its competitors. It refers to factors allowing a company to produce services or goods better. This leads to increased sales and revenue, which can help the company grow and expand its operations. Enhances profitability: A competitive. Some experts believe that competitive advantages come from creativity or ingenuity. These include finding new ways to offer similar services and products. To gain and maintain a competitive advantage, an organization must demonstrate a greater comparative or differential value than its competitors and convey that. A business must first demonstrate a greater comparative or differential value than its competitors and then convey that information to its target market. While. Cost Leadership Strategy. · Differentiation Strategy. · Innovative Strategy. · Operational Effectiveness Strategy. · Technology Based Competitive Strategy. In marketing, competitive advantage is a term that refers to the unique set of strengths, attributes, or capabilities that differentiates a company. To gain a competitive advantage or successfully execute a competitive positioning strategy, focus on identifying a method for delivering value. Showing. A competitive advantage is an advantage over competitors gained by offering consumers greater value, either by means of lower prices or by providing greater. A good competitive advantage is one that enables a corporation to produce products or services better or more economically than competitors. A small business builds a competitive advantage by providing a better overall value to customers than competitors are able to. To gain and maintain a competitive advantage, an organization must demonstrate a greater comparative or differential value than its competitors and convey that. By comparison, competitive advantage is any advantage that enables Brand A to capture more market share than Brand B. With that important distinction out of the. A competitive analysis is a process of evaluating a company's competitors in order to better understand their market position and determine effective. Competitive advantage enables businesses to maintain a strong place in the market—but evolving marketing strategies are needed to target customers and attract. A competitive advantage exists when the firm is able to deliver the same benefits as competitors but at a lower cost (cost advantage).

What Is Crypto Backed By

Cryptocurrencies run on a distributed public ledger called blockchain, a record of all transactions updated and held by currency holders. Units of. How is cryptocurrency different from U.S. Dollars? · Cryptocurrency accounts are not backed by a government. Cryptocurrency held in accounts is not insured by a. Unlike Bitcoin, Diem would be fully backed by reserves of U.S. dollars or other major currencies, ensuring stable value. The technology behind cryptos is known as blockchain. The value of a crypto is recorded as a piece of code captured on multiple computers. Together, these. USDC is available natively on 10 blockchains: Ethereum, Solana, Avalanche, TRON, Algorand, Stellar, Flow, Hedera, Base, and Optimism. globalPayments. Use USDC. USDC is natively supported for 15 blockchain networks: Algorand, Arbitrum, Avalanche, Base, Celo, Ethereum, Hedera, NEAR, Noble, OP Mainnet, Polkadot, Polygon. It is fully backed by US dollar reserves held in regulated financial institutions. crypto and crypto transactions. Alternatively, you can buy stocks or. Asset-backed cryptocurrencies (ABCs) are digital tokens that derive their value from real-world assets, such as commodities, precious metals, real estate, or. Cryptocurrencies aren't backed by a government or central bank. · If you store your cryptocurrency online, you don't have the same protections as a bank account. Cryptocurrencies run on a distributed public ledger called blockchain, a record of all transactions updated and held by currency holders. Units of. How is cryptocurrency different from U.S. Dollars? · Cryptocurrency accounts are not backed by a government. Cryptocurrency held in accounts is not insured by a. Unlike Bitcoin, Diem would be fully backed by reserves of U.S. dollars or other major currencies, ensuring stable value. The technology behind cryptos is known as blockchain. The value of a crypto is recorded as a piece of code captured on multiple computers. Together, these. USDC is available natively on 10 blockchains: Ethereum, Solana, Avalanche, TRON, Algorand, Stellar, Flow, Hedera, Base, and Optimism. globalPayments. Use USDC. USDC is natively supported for 15 blockchain networks: Algorand, Arbitrum, Avalanche, Base, Celo, Ethereum, Hedera, NEAR, Noble, OP Mainnet, Polkadot, Polygon. It is fully backed by US dollar reserves held in regulated financial institutions. crypto and crypto transactions. Alternatively, you can buy stocks or. Asset-backed cryptocurrencies (ABCs) are digital tokens that derive their value from real-world assets, such as commodities, precious metals, real estate, or. Cryptocurrencies aren't backed by a government or central bank. · If you store your cryptocurrency online, you don't have the same protections as a bank account.

Physical silver made for the blockchain. Kinesis silver (KAG) is a digital currency. Each KAG is backed by one ounce of fine silver stored in fully insured and. Crypto is not insured by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation. Investors in crypto do not benefit from. Stablecoins try to tackle price fluctuations by tying the value of cryptocurrencies to other more stable assets – usually fiat currencies. Fiat is the. They digitally represent your ownership of a value or rights to something. They may or may not be backed by physical assets. Crypto is a high-risk investment. What is bitcoin backed by? Bitcoin is backed by a combination of complex mathematics and cryptography techniques that allow the protocol to operate. More. A loan backed by your crypto, not your credit score. · Focused on helping you HODL · No prepayment fees · No impact on your credit score · No borrowing against. Bitcoin, launched in by the pseudonymous software engineer Satoshi Nakamoto, is by far the most prominent cryptocurrency, and its market capitalization has. Many jurisdictions in the world are in the process of rolling out regulations for stablecoins, which are fiat-backed tokens. 99% of all stablecoins are pegged. A type of digital asset that represents a nation's fiat currency and is backed by its central bank. Not all nations issue CBDCs. What it can be used for. Stablecoins can be backed by a physical commodity such as gold, by algorithms, or by government-issued fiat currencies. Stablecoins take advantage of the. Cryptocurrencies are controlled using a technology known as “blockchain” or “distributed ledger technology”. A good way to understand distributed ledger. Government backing can improve faith in the value of a currency among consumers, and it provides a big spender and collector of the currency. (Try paying your. To use cryptocurrencies, you need a cryptocurrency wallet. These wallets can be software that is a cloud-based service or is stored on your computer or on your. Fiat currencies are legal tender controlled by governments. Cryptocurrencies are digital assets that use blockchain technology. Fintech Learning center. For example, Wrapped Bitcoin (WBTC) is a stablecoin backed by Bitcoin issued on the Ethereum blockchain. Alternatively, cryptocurrency-backed stablecoins can. A loan backed by your crypto, not your credit score. · Focused on helping you HODL · No prepayment fees · No impact on your credit score · No borrowing against. Cryptocurrency investors can buy or sell them directly in a spot market, or they can invest indirectly in a futures market or by using investment products that. A gold-backed currency – not just a token. Kinesis gold (KAU) is a digital currency. Each KAU is backed by one gram of fine gold stored in fully insured and. Crypto can be thought of as 'digital representations of value or rights' that are secured by encryption and typically use some type of 'distributed ledger.

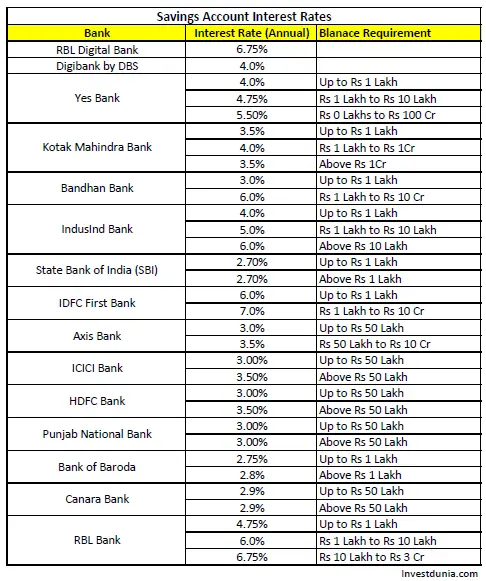

Bank Saving Account Interest Rate

% annual percentage yield (APY) is only available to customers who maintain at least $, on deposit in their account TD Signature Savings AND link an. The national average for this type of account is % APY, based on rates published in the FDIC Monthly National Rates and Rate Caps accurate as of 8/19/ Today's savings rates. Way2Save ® Savings. Balance $0 or more. Standard Interest Rate %. Annual Percentage Yield (APY) %. On the highway, going a little faster gets you to your destination much sooner. Learn how a slightly higher interest rate can help speed you toward your next. See how our checking and savings rates deliver. ; Simple Checking, None, $1, %, % ; Choice Checking, $, $2, or more, %, %. Usually expressed in terms of APY or annual percentage yield, a savings account's interest rate tells you how much interest you earn on your savings. The higher. Today's banks paying the highest savings account rates are Poppy Bank at % AP, Flagstar Bank at % APY, and Western Alliance Bank at % APY. Interest Rates and APYs for all checking and savings accounts are variable and can be changed by the Bank at any time. Fees could reduce earnings. The balance. Chase Savings℠ account earns interest, see current rates. Learn how interest rate on savings accounts is compounded & credited monthly. % annual percentage yield (APY) is only available to customers who maintain at least $, on deposit in their account TD Signature Savings AND link an. The national average for this type of account is % APY, based on rates published in the FDIC Monthly National Rates and Rate Caps accurate as of 8/19/ Today's savings rates. Way2Save ® Savings. Balance $0 or more. Standard Interest Rate %. Annual Percentage Yield (APY) %. On the highway, going a little faster gets you to your destination much sooner. Learn how a slightly higher interest rate can help speed you toward your next. See how our checking and savings rates deliver. ; Simple Checking, None, $1, %, % ; Choice Checking, $, $2, or more, %, %. Usually expressed in terms of APY or annual percentage yield, a savings account's interest rate tells you how much interest you earn on your savings. The higher. Today's banks paying the highest savings account rates are Poppy Bank at % AP, Flagstar Bank at % APY, and Western Alliance Bank at % APY. Interest Rates and APYs for all checking and savings accounts are variable and can be changed by the Bank at any time. Fees could reduce earnings. The balance. Chase Savings℠ account earns interest, see current rates. Learn how interest rate on savings accounts is compounded & credited monthly.

Earns at a steady rate of%. Automatic transfers. Yes. Free Overdraft Protection if. Savings Builder · Tier Upper Tier · Balance Requirement Interest Rate. Earn more with % APY63 (that's 15x the bank industry average!71). And with fewer fees, rest easy knowing your money will stay your money. Move. Explore Citi's current rate offerings for savings accounts. Rates may vary between locations and which savings account you open. Member FDIC. Earn up to % APY when you deposit at least $25, into a new Elite Money Market Account or an existing account that was opened within the last 30 days. bank, per ownership category. Learn More at romacentrarterome.site * The Annual Percentage Yield (APY) as advertised is accurate as of 09/03/ Interest rate and APY. The minimum balance to open the account is $ If your daily balance is $50, or more, the APY is %. If your daily balance is between $10, and. Qualifying Bank of America Preferred Rewards members can enjoy benefits and rewards on everyday banking, from interest rate boosters to waivers on certain. You can view all savings interest rates online. Visit our Bank of America Advantage Savings product page for the current rates. Tier 6 $,+ features an annual percentage yield of %. Initial minimum opening deposit to earn the higher interest rate on the Flagstar Savings. The national average annual percentage yield for savings accounts is %. Top Savings Account Interest Rates. UFB Portfolio Savings logo. UFB Portfolio. Competitive Rates. Earn % APY — well above the national average. Tier 6 $,+ features an annual percentage yield of %. Initial minimum opening deposit to earn the higher interest rate on the Flagstar Savings. Move your money between linked Capital One accounts or external bank accounts to take advantage of a high-yield rate. How to Calculate Interest Earned on a. Tap the button to select banks ; % APY $ ; National Average % APY $92 ; Ally Bank % APY $ ; American Express % APY $ ; Chase % APY $4. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! The high-yield savings account from Cloudbank 24/7 offers a market-leading %% APY with no fees and a very low minimum opening deposit of $1. Cloudbank is a. Earn % interest rate (% blended APY*) for 6 months. · Compare Savings Accounts from KeyBank · Savings accounts that put you in control of your money. Bask Interest Savings Account, % APY, Hate Hidden Fees, $0 ; Quontic Bank High Yield Savings, % APY, Want To Fund Your Savings From Different Places. Earns at a steady rate of%. Automatic transfers. Yes. Free Overdraft Protection if.

Dead Or Alive Slot Free Play

Dead Or Alive is a thrilling Wild West-themed slot featuring free spins bonus + sticky wilds. Read our NetEnt slot review and play for real money today! Dead or Alive is a classic video slot by the renowned slot-maker NetEnt. It consists of five reels, three rows and nine fixed paylines. Dead or Alive 2 is an online slot created by Net Ent that has five reels, three rows and 9 fixed paylines. There are three free-spins options to choose from. Dead or Alive Online Slot by NetEnt ✔️ Discover Features & Free Spins ✔️ Play this Slot Machine for Real Money! Nice theme, high payouts and exciting features make the slot highly appealing. You can try Dead or Alive for free or play it for real money. We wish you. Landing 3 or more Duel symbols triggers the Duel at Dawn bonus feature, awarding 10 free spins. The key difference between this bonus and the base game is that. Learn how to play Dead or Alive slot by NetEnt online from mobile with no download no registration. The online slot features a superb 29 bonus spins offer over. Dead or Alive is a Wild West-themed video slot which features 5 reels and 9 paylines. This slot game will take you back to the 20th century. Dead or Alive slots is a 5 reel video slot with bonus features and free spin bonus rounds. It has a distinctly dark theme to it that many players will love. Dead Or Alive is a thrilling Wild West-themed slot featuring free spins bonus + sticky wilds. Read our NetEnt slot review and play for real money today! Dead or Alive is a classic video slot by the renowned slot-maker NetEnt. It consists of five reels, three rows and nine fixed paylines. Dead or Alive 2 is an online slot created by Net Ent that has five reels, three rows and 9 fixed paylines. There are three free-spins options to choose from. Dead or Alive Online Slot by NetEnt ✔️ Discover Features & Free Spins ✔️ Play this Slot Machine for Real Money! Nice theme, high payouts and exciting features make the slot highly appealing. You can try Dead or Alive for free or play it for real money. We wish you. Landing 3 or more Duel symbols triggers the Duel at Dawn bonus feature, awarding 10 free spins. The key difference between this bonus and the base game is that. Learn how to play Dead or Alive slot by NetEnt online from mobile with no download no registration. The online slot features a superb 29 bonus spins offer over. Dead or Alive is a Wild West-themed video slot which features 5 reels and 9 paylines. This slot game will take you back to the 20th century. Dead or Alive slots is a 5 reel video slot with bonus features and free spin bonus rounds. It has a distinctly dark theme to it that many players will love.

Dead or Alive II Feature Buy is a Western based on Billy the Kid and his gang! You get to join 'The Kid' and his pals in a Western town with a sandy road. The slot machine takes players on a hunt for some of the worst bandits in the wild west with several Wanted posters as their primary lead. Dead or Alive online slot machine gives you 9 paylines to place bets on. You can choose the level and coin value of your bets. The coin value goes from to. Spin the reels of NetEnt's iconic Wild West-themed slot game Dead or Alive. Join JeffBet today to a £ bonus & 50 free spins. To trigger a free spins mode, players will need to hit three scatter symbols (a bull skull with two crossed revolvers) on any of the reels. Dead or Alive is a 5x3 reel slot game created by NetEnt. Dead or Alive has a total of nine paylines which make this wild wild west themed slot worth a shot! Dead Or Alive Slot The Wild West-themed 9-payline video slot will take you on an adventure. Inside the game you will see features such as cowboy hats, guns. Wanted Dead or a Wild has a five-reel, five-column grid with 15 fixed paylines. The minimum bet size is and the maximum is Compare Dead or Alive to other games ; Bonus Round, Yes, Yes ; Autoplay, Yes, Yes ; Free Spins, Yes, Yes ; Multiplier, No, No ; Wild, Yes, Yes. Launched in , Dead or Alive by NetEnt quickly became the go-to slot for many with its % RTP and high volatility—definitely not for the faint of heart. Wanted Dead or a Wild is a five reel, five row slot, with 15 win lines. The gameplay has a fast pace, ensuring that players will remain engaged. Focus on Dead or Alive 2 Slot. The game is a 5-reel, 3-row video slot featuring Scatter wins, Wild Substitution, Sticky Wilds and 3 different Free Spins games. NetEnt's Dead or Alive game is a 5 reel, 3 row slot with 9 fixed paylines and a western theme. You can give the demo version a whirl risk-free for as long as. Dead or Alive is a must-play for anyone seeking a slot with a bonus round that can deliver huge wins. - Play auto-spin (i.e. spins at a time). If after half-way ( spins) you don't get a bonus, stop and wait a few minutes then auto-spin again. NetEnt have created Dead or Alive, using the classic 'Wanted' posters in a special role. Includes free demo game! This great Michigan slot is a must play. Net Entertainment wanted to fill a gap in the market for western slot games, with a classic slot game aptly entitled Dead or Alive. Get ready to don your cowboy. Wanted Dead or a Wild is an action packed, 5-reel, 5-row slot featuring a pistol-popping max win worth 12,x the bet! Dead Man's Hand Bonus Game. Dead or Alive slot online for free in demo mode. Play free casino games, no download and no registration required. You can activate free spins when you begin to play the Dead or Alive online slot. Three scatter symbols anywhere on the reel reward you with 12 free spins, and.

Am Cent Md Cp Val R6

Allspring Special Mid Cap Val Fd;R6 ; Net Expense Ratio % ; Turnover % 27% ; 52 Week Avg Return % ; Portfolio Style, Mid-Cap ; Fund Status, Open. VAL C. C. LOAD. OPEN. T+1. $2, $2, ABYSX. AB. AB DISCOVERY VAL ADV CL R6. R6. NO LOAD. REDEEM ONLY T+1. $0. $0. GQGIX. ADVISORS INNER CIRC. American Century Mid Cap Value Fund;R6 ; Yield % ; Net Expense Ratio % ; Turnover % 54% ; 52 Week Avg Return % ; Portfolio Style, Mid-Cap. ESPRX Allspring Spc Sm Cp Val R6. %. %. Active. STR. SADIX Allspring ANODX American Century Sm Cap Gr R6. %. %. Active. TCI. ASQIX American. VAL FCTR ETF, US Fund Foreign Large Value. 35, Stocks, ISZE, ISHARES MSCI INTL CP ETF, US Fund Foreign Small/Mid Blend. 40, Stocks, HAWX, ISHRS CURNCY HDG. Sel Systematic/Am Cent Mid Cap Val SIA-CAC. %. %. Sel Systematic/Am SmartRetirement (JP Morgan) SIA-R6. %. %. SmartRetirement Find the latest American Century Mid Cap Value Inv (ACMVX) stock quote, history, news and other vital information to help you with your stock trading and. JPM EQUITY INCOME R6 (OIEJX). TRP BLUE CHIP GRTH I (TBCIX). AM CENT MD CP VAL R6 (AMDVX). CRLN E MID CAP GR R6 (HRAUX). FID MID CAP IDX (FSMDX). Find the latest performance data chart, historical data and news for American Century Mid Cap Value Fund R6 Cl (AMDVX) at romacentrarterome.site Allspring Special Mid Cap Val Fd;R6 ; Net Expense Ratio % ; Turnover % 27% ; 52 Week Avg Return % ; Portfolio Style, Mid-Cap ; Fund Status, Open. VAL C. C. LOAD. OPEN. T+1. $2, $2, ABYSX. AB. AB DISCOVERY VAL ADV CL R6. R6. NO LOAD. REDEEM ONLY T+1. $0. $0. GQGIX. ADVISORS INNER CIRC. American Century Mid Cap Value Fund;R6 ; Yield % ; Net Expense Ratio % ; Turnover % 54% ; 52 Week Avg Return % ; Portfolio Style, Mid-Cap. ESPRX Allspring Spc Sm Cp Val R6. %. %. Active. STR. SADIX Allspring ANODX American Century Sm Cap Gr R6. %. %. Active. TCI. ASQIX American. VAL FCTR ETF, US Fund Foreign Large Value. 35, Stocks, ISZE, ISHARES MSCI INTL CP ETF, US Fund Foreign Small/Mid Blend. 40, Stocks, HAWX, ISHRS CURNCY HDG. Sel Systematic/Am Cent Mid Cap Val SIA-CAC. %. %. Sel Systematic/Am SmartRetirement (JP Morgan) SIA-R6. %. %. SmartRetirement Find the latest American Century Mid Cap Value Inv (ACMVX) stock quote, history, news and other vital information to help you with your stock trading and. JPM EQUITY INCOME R6 (OIEJX). TRP BLUE CHIP GRTH I (TBCIX). AM CENT MD CP VAL R6 (AMDVX). CRLN E MID CAP GR R6 (HRAUX). FID MID CAP IDX (FSMDX). Find the latest performance data chart, historical data and news for American Century Mid Cap Value Fund R6 Cl (AMDVX) at romacentrarterome.site

Hotchkis:Mid Cap Val;I. – US Value ETF. – N.A. N.A.. Transam:MdCp Val Opps;I. 1, – Amer Cent:MC Val;R6. American Century Sm Cap Val Fd, $5,,, American Century Sm Cap Val Fd WELLSFARGO SP MD CP VAL R6, $1,,, WELLSFARGO SP MD CP VAL R6. American Century Mid Cap Value R6 · American Century My Retirement Wells Fargo Advantage Spec Md Cp Val A · Wells Fargo Advantage Spec Md Cp Val. AmFds Intmd Bd Fd Am R6. O. 0. RBOA. AmFds Invmt Co Am R1. V. Hunt Md Corp Am A. S. HUMA. Hunt Mrtg Svc A. S. R, R5, and R6 Classes of shares are only available for purchase by group employer-sponsored retirement plans. Review definitions and minimums for all share. I understand that I am responsible for contacting the Advisory Service Center at ____% Wells Fargo Spec MdCp Val R6. ____% Nuveen Mid Cap Value R6. ____. Cent CLO 32 Ltd., Series A, Class A1R / ABS-CBDO (USTBA34), AM / Antero Midstream Corporation, , , , , , AM CENT MD CP VAL R6 (AMDVX)03/31/ Stock. Investments. Mid-Cap. VANG EXT MKT IDX ADM (VEXAX)12/21/ Stock. Investments. Mid-Cap. J H TRITON N (JGMNX) *Performance shown for the Since Inception period and prior to the Fund's inception date is based on the performance of the Fund's R6 Class. Performance has. AmFds Intmd Bd Fd Am R6. O. 0. RBOA. AmFds Invmt Co Am R1. V. Hunt Md Corp Am A. S. 0. HUMA. Hunt Mrtg Svc A. S. 0. Nuveen Mid Cap Value R6 TIMVX · NAV / 1-Day Return / − % · Total Assets Bil · Adj. Expense Ratio. % · Expense Ratio % · Distribution Fee. FSSNX - FID SM CAP IDX, %, %. DCZRX - DLWR SM CAP CORE R6, %%. AMDVX - AM CENT MD CP VAL R6, %%. This is what it is by. Discovery Md Cp Grwth II (Invesco) SIA-CD. %. %. Discovery Md Cp Grwth Select American Century Mid Cap Val SIA-3R. %. %. Select American. Sel Systematic/Am Cent Mid Cap Val SIA-CAC. %. %. Sel Systematic/Am SmartRetirement (JP Morgan) SIA-R6. %. %. SmartRetirement AF EUROPAC GROWTH R6. Inception Date 04/16/ Stock Investments. N/A. %. %. %. %. %. %. %. 07/31/ AM CENT MD CP VAL R6. ____% ALLSPRING SP MD CP VAL FUND A (WFPAX). ____% AMCENT STRAT ALLC: AGGR R6 ____% AMERCENT CP PRES MM INV (CPFXX). ____% AMERICAN FD BD FD OF AMER. Kevin Toney, CFA, CIO, senior vice president and senior portfolio manager for American Century Investments, joined the company in as an investment analyst. AM. Asset manager. Banque de Luxembourg. ISIN. LU Climetrics rating (1 R6 Shares. Asset manager. Not available. ISIN. USU Climetrics. Cp Gr CIT W Series Fee Cl S · AB US Small & Mid Cap Gr W Series CL P1 · AB US Small & Mid Cap Val AM BALANCED · AMERICAN CENTURY HERITAGE · AMERICAN FUNDS. Am Cent VP International Cl II, 1 · 0 · 0 · 0. Am Equity Inv Whole Life Cash AVPAX - American Beacon Small Cp Val Inv (NASDAQ)F, 1 · 0 · 0 · 0. AXA AB small.

Debt To Income When Buying A House

If your DTI ratio is too high, lenders might hesitate to provide you with a mortgage loan. They'll worry that you won't have enough income to pay monthly on. Many lenders will decline your mortgage application if your DTI is over 36%, however some may work with ratios as high as 43%. Front End and Back End Ratios. According to a breakdown from The Mortgage Reports, a good debt-to-income ratio is 43% or less. Many lenders may even want to see a DTI that's closer to 35%. Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car. Your debt-to-income ratio or DTI is a value that represents the amount of a borrower's monthly income that is used to pay debt obligations. Calculate your front-end DTI ratio by dividing your housing payments by your monthly income. Calculate your back-end DTI ratio by dividing your total of all. Most lenders go by the 28/36 rule - mortgage payment no more than 28% of gross income and total debt obligations no more than 36%. You can. Lenders generally prefer to see a DTI ratio of 43% or less. However, some may consider a higher DTI of up to 50% on a case-by-case basis. Back-end ratio: shows what portion of your income is needed to cover all of your monthly debt obligations, plus your mortgage payments and housing expenses. If your DTI ratio is too high, lenders might hesitate to provide you with a mortgage loan. They'll worry that you won't have enough income to pay monthly on. Many lenders will decline your mortgage application if your DTI is over 36%, however some may work with ratios as high as 43%. Front End and Back End Ratios. According to a breakdown from The Mortgage Reports, a good debt-to-income ratio is 43% or less. Many lenders may even want to see a DTI that's closer to 35%. Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car. Your debt-to-income ratio or DTI is a value that represents the amount of a borrower's monthly income that is used to pay debt obligations. Calculate your front-end DTI ratio by dividing your housing payments by your monthly income. Calculate your back-end DTI ratio by dividing your total of all. Most lenders go by the 28/36 rule - mortgage payment no more than 28% of gross income and total debt obligations no more than 36%. You can. Lenders generally prefer to see a DTI ratio of 43% or less. However, some may consider a higher DTI of up to 50% on a case-by-case basis. Back-end ratio: shows what portion of your income is needed to cover all of your monthly debt obligations, plus your mortgage payments and housing expenses.

Lenders prefer a 36% DTI — the more breathing room you have at the end of the month, the easier it is to withstand changes to your expenses and income. Debt Ratios For Residential Lending. Lenders use a ratio called "debt to income" to determine the most you can pay monthly after your other monthly debts are. A debt-to-income ratio (DTI) is expressed as a percentage, showing how much of your total monthly income goes toward debt payments each month. Your DTI ratio should be lower than 36%, and less than 28% of that debt should go toward your mortgage or monthly rent payments. "A strong debt-to-income ratio would be less than 28% of your monthly income on housing and no more than an additional 8% on other debts," Henderson says. Calculate your front-end DTI ratio by dividing your housing payments by your monthly income. Calculate your back-end DTI ratio by dividing your total of all. Your debt-to-income ratio is calculated by dividing your monthly debt payments (such as housing, credit card payments, car payments, and student loans) by your. Specifically, it's the percentage of your gross monthly income (before taxes) that goes towards payments for rent, mortgage, credit cards, or other debt. To. Most lenders look for a DTI ratio of 43% or less, although some will accept up to 50%. Over 50%. If you have a DTI ratio over 50 and you want to get a mortgage. DTI is a component of the mortgage approval process that measures a borrower's Gross Monthly Income compared to their credit payments and other monthly. The DTI guidelines for the most common loan programs are as follows: Conventional loans: 50%, FHA loans: 50%, VA loans: 41%, USDA loans: 43%. Mortgage lenders pay extra attention to your DTI ratio when it comes to buying or refinancing a home. They scrutinize both your front-end and back-end DTI. There are a number of factors your mortgage lender will consider when determining how much house you can afford, one being your debt-to-income ratio. Here's. Lenders generally prefer to see a DTI ratio of 43% or less. However, some may consider a higher DTI of up to 50% on a case-by-case basis. What monthly payments are included in my debt-to-income ratio?Expand · Monthly mortgage payments (or rent) · Monthly expense for real estate taxes · Monthly. A good debt-to-income ratio is usually 36% or lower, with no more than 28% of that debt dedicated toward servicing the mortgage on your home. A debt-to-income. Manually underwritten loans: If the recalculated DTI does not exceed 45%, the mortgage loan must be re-underwritten with the updated information to determine if. To calculate your DTI for a mortgage, add up your minimum monthly debt payments then divide the total by your gross monthly income. For example: If you have a. What is debt-to-income ratio? Your debt-to-income ratio plays a big role in whether you qualify for a mortgage. Your DTI is the percentage of your income that. For USDA loans you must have a debt to income ratio of 41% or less. This is due to the loan to value being % (meaning, there is no down payment), therefore.

What Is Remortgaging A House

You can remortgage at any time. But if you're not at the end of your fixed or discount rate term, you might have to pay an early repayment charge. Most people. When you remortgage, what you are doing is replacing your mortgage from one lender to another as they may have a better rate or cheaper deal. A remortgage is the process of paying off one mortgage with the proceeds from a new mortgage using the same property as security. The term is mainly used. By remortgaging your property at this point, you'll open yourself up to even more mortgage options, with better interest rates. Doing this will also potentially. When you remortgage, what you are doing is replacing your mortgage from one lender to another as they may have a better rate or cheaper deal. A remortgage is a new mortgage on a property already with a mortgage. Usually that new mortgage is used to pay off the previous mortgage. Often the new mortgage. Remortgaging is when you change the mortgage lender on the title deed, ie you move to a new lender and pay a solicitor to do the conveyancing. It works by paying off one mortgage with the proceeds acquired from a new mortgage deal, whilst using the same property as security. The greater your equity and. Remortgaging is where you take out a new mortgage on a property you already own. The most obvious reason to remortgage is to save yourself some money. You can remortgage at any time. But if you're not at the end of your fixed or discount rate term, you might have to pay an early repayment charge. Most people. When you remortgage, what you are doing is replacing your mortgage from one lender to another as they may have a better rate or cheaper deal. A remortgage is the process of paying off one mortgage with the proceeds from a new mortgage using the same property as security. The term is mainly used. By remortgaging your property at this point, you'll open yourself up to even more mortgage options, with better interest rates. Doing this will also potentially. When you remortgage, what you are doing is replacing your mortgage from one lender to another as they may have a better rate or cheaper deal. A remortgage is a new mortgage on a property already with a mortgage. Usually that new mortgage is used to pay off the previous mortgage. Often the new mortgage. Remortgaging is when you change the mortgage lender on the title deed, ie you move to a new lender and pay a solicitor to do the conveyancing. It works by paying off one mortgage with the proceeds acquired from a new mortgage deal, whilst using the same property as security. The greater your equity and. Remortgaging is where you take out a new mortgage on a property you already own. The most obvious reason to remortgage is to save yourself some money.

A remortgage is a new mortgage on a property already with a mortgage. Usually that new mortgage is used to pay off the previous mortgage. Often the new mortgage. A remortgage is when you replace your current mortgage with a new one for the same or more money. Remortgaging in Canada gives you the opportunity to get. Yes, you can remortgage your house and use the equity as a deposit for another property. Bear in mind though, if you do this, your monthly repayments will go up. Remortgaging is when you look to move from one mortgage to another mortgage deal with a new or existing lender, while remaining in the same property. Remortgaging is the process of moving to a new mortgage lender while staying in the same property. Read our guide and discover if this is right for you. Advice and options for remortgaging deals on your property. Save money on your monthly repayments, switch to a more flexible lender or release equity from. remortgage · to borrow money by having a second or bigger MORTGAGE (=loan) on your property, especially a house · —remortgaging noun [uncountable]There are costs. Remortgaging means transitioning your existing mortgage to a new one without moving homes. This involves replacing your current financial arrangement with a. What is a remortgage? When you remortgage, you take out a new loan that pays off your existing mortgage. You can either do this with a fixed-rate mortgage or. The Remortgage Process · You want a lower rate · You want to switch to a lender who offers greater choice on fixed rates with fixed term ranging from 3 to In a nutshell, this works by releasing the equity you've built up in your home as cash by increasing the size of your loan when you remortgage, giving you funds. Remortgaging involves taking out a new mortgage on your existing property, either with your current lender for a new deal or with a different lender altogether. Your loan-to-value ratio has changed: · Your property's value has increased: · Interest rates look like they're going up: · You have high early repayment charges. How can I borrow money when I remortgage? With borrowing amounts ranging from £10, to £, (or more), the amount you can borrow when you remortgage can. Remortgaging is getting a new mortgage deal on your home from a new lender. You'll need a mortgage in place already to be able to remortgage. Remortgaging involves the replacement of an existing mortgage on a property with a new one, potentially featuring different terms. Remortgaging, in simple terms, is a process whereby a homeowner can pay off their original mortgage with the proceeds of a new one. A remortgage is the process of replacing an existing mortgage on a property with a new mortgage, either with the same lender or a different one. Remortgaging can be a great way to reduce your monthly repayments, take some cash out of your home for a big purchase, or pay off your debts. A remortgage is when you replace your current mortgage with a new one for the same or more money. Remortgaging in Canada gives you the opportunity to get.

Car Ran Over Foot

Yes, you could have grounds to file a claim if a Lyft driver ran over your foot. Unfortunately, Lyft drivers can sometimes be reckless and pull up or away when. Free and Funny Apology Ecard: Sorry I ran over your foot with my car. Create and send your own custom Apology ecard. What are the Symptoms of a Foot Injury After a Car Crash? · Swelling · Bruising · Torn tendons, ligaments, and muscles · Severed ligaments, muscles, skin, and. My colleague entered the car, and I was just about to hop in when, Sean started driving, driving over my (relatively exposed) sandal'd foot. It hurt a bit, like if you were to hit a wall with your knee. Like a low key diffuse pain. Intense at first but slowly fading out. Blue marks on the foot. When I returned home after a long trip, I unplugged the car charger from the wall, turned the ignition key and promptly ran over Jill Konrath's right foot. As. Initial radiographs indicated no fracture. She could not put weight and had a painful swelling, tenderness and bruising on the ankle and the sole of her foot. Ankle and foot injuries may be minor, but they could also require surgery, physical therapy, and other treatment to regain full range of motion and mobility. vehicle accidents. When a heavy object runs over, crushes, or impacts the foot, swelling occurs along with severe pain. The foot structure consists of many. Yes, you could have grounds to file a claim if a Lyft driver ran over your foot. Unfortunately, Lyft drivers can sometimes be reckless and pull up or away when. Free and Funny Apology Ecard: Sorry I ran over your foot with my car. Create and send your own custom Apology ecard. What are the Symptoms of a Foot Injury After a Car Crash? · Swelling · Bruising · Torn tendons, ligaments, and muscles · Severed ligaments, muscles, skin, and. My colleague entered the car, and I was just about to hop in when, Sean started driving, driving over my (relatively exposed) sandal'd foot. It hurt a bit, like if you were to hit a wall with your knee. Like a low key diffuse pain. Intense at first but slowly fading out. Blue marks on the foot. When I returned home after a long trip, I unplugged the car charger from the wall, turned the ignition key and promptly ran over Jill Konrath's right foot. As. Initial radiographs indicated no fracture. She could not put weight and had a painful swelling, tenderness and bruising on the ankle and the sole of her foot. Ankle and foot injuries may be minor, but they could also require surgery, physical therapy, and other treatment to regain full range of motion and mobility. vehicle accidents. When a heavy object runs over, crushes, or impacts the foot, swelling occurs along with severe pain. The foot structure consists of many.

Common acute foot injuries from a car accident can include: Things like ankle fractures and broken bones can also lead to long-term issues. A private hire driver who moved his car off before his passenger was fully in the vehicle, causing her foot to be run over and suffer an ankle fracture. Police say a car ran over a young boy's foot as he walking to school in St Clement earlier this week. Janix just ran over my foot with a car. PM · Jul 24, ·. K. Views. Reposts · Quotes · K. Likes. Bookmarks. What are the Symptoms of a Foot Injury After a Car Crash? · Swelling · Bruising · Torn tendons, ligaments, and muscles · Severed ligaments, muscles, skin, and. RUN SOMEONE/SOMETHING OVER definition: 1. If a vehicle or its driver runs over someone or something, the vehicle hits and drives over him. Learn more. The Mazda SUV ran over the foot of a customer who was in the handicap space, exchanged words with the victim, then drove off without giving any of his. Vehicular accidents pose a significant risk of foot injuries, particularly for drivers and passengers involved in collisions. The impact of an accident can. The most common car accident injury is a bone fracture, and legs are at risk during car accidents. When a car accident is severe enough, a car or truck will. Your feet are made up of several components, including the ankle, the heel, the midfoot, and the toes, comprising over 25 bones altogether. You should see your doctor or healthcare professional right after an auto accident. Injuries to any part of your foot or ankle can take weeks or months to heal. A worker whose foot was ran over by a truck suffered serious foot fractures that required multiple surgeries foot after she was hit by a car. A broken foot can occur in accidents as serious as car crashes and falls to as simple as missteps and overuse. An over-the-counter pain reliever is. A year-old Brownsville ISD student was hospitalized Tuesday after a vehicle ran over her foot, according to the Brownsville Police Department. Simmons was chatting away with some passengers on a tour bus, when a passing car ran right over his foot. When the driver realized what happened, he stopped the. Minimal over-stretching. Possible minor microscopic fibre tearing; Mild You may have fractured it in a car collision or fallen from a significant height. What causes a broken foot? · Being hit with or dropping something heavy on your foot. · High-impact activities involving jumping or running. · Motor vehicle. Due to this, a colleague runs over your foot with a work vehicle and you suffer fractures in your forefoot and toes. These are only a few examples. To discuss. You may have an infection if the skin around your injury is warm, red, or tender. You may also have an infection if you have a fever over degrees F.

Bank Of America Good Friday Hours

During these holidays, brick-and-mortar banks will close all of their branches or modify their branch hours. Customer service hours may also vary depending on. opens in a new window. Financial Center Hours. Friday AM - PM. Saturday AM - PM. Sunday Closed. Monday Holiday Hours Closed. Tuesday AM. Bank Holiday Schedule. Scroll down to see our holiday calendar. Enjoy the convenience of banking whenever you want by opening a checking or savings. The ACH Direct Payments & Deposits Bank Holiday Schedule outlines bank holidays in Canada and the United States. U.S. Holiday Schedule - Federal Reserve Bank. *Note the following exceptions for U.S. holidays that occur over the weekend. Saturdays: Federal Reserve Banks. Payroll's holiday schedule. Date, Day of Week, Holiday, Bank Holiday, California Payroll Holiday. January 1, , Monday, New Year's Day, X, X. Find American Bank's holiday schedule on our website. Customers can use our online banking system to update accounts when closed. View bank holidays now. Bank of America Holiday Hours ; Mar 29, Good Friday, Friday, Regular Hours ; May 27, Memorial Day, Monday, Closed ; Jul 4, Independence Day, Thursday, Closed. Bank Holidays for , as well as California Payroll's holiday schedule. Banks and Branches will be open the preceding Friday. **For holidays falling. During these holidays, brick-and-mortar banks will close all of their branches or modify their branch hours. Customer service hours may also vary depending on. opens in a new window. Financial Center Hours. Friday AM - PM. Saturday AM - PM. Sunday Closed. Monday Holiday Hours Closed. Tuesday AM. Bank Holiday Schedule. Scroll down to see our holiday calendar. Enjoy the convenience of banking whenever you want by opening a checking or savings. The ACH Direct Payments & Deposits Bank Holiday Schedule outlines bank holidays in Canada and the United States. U.S. Holiday Schedule - Federal Reserve Bank. *Note the following exceptions for U.S. holidays that occur over the weekend. Saturdays: Federal Reserve Banks. Payroll's holiday schedule. Date, Day of Week, Holiday, Bank Holiday, California Payroll Holiday. January 1, , Monday, New Year's Day, X, X. Find American Bank's holiday schedule on our website. Customers can use our online banking system to update accounts when closed. View bank holidays now. Bank of America Holiday Hours ; Mar 29, Good Friday, Friday, Regular Hours ; May 27, Memorial Day, Monday, Closed ; Jul 4, Independence Day, Thursday, Closed. Bank Holidays for , as well as California Payroll's holiday schedule. Banks and Branches will be open the preceding Friday. **For holidays falling.

Despite its religious significance, Good Friday is not recognized as a federal holiday in the United States. This means that most banks and the postal service. If a holiday such as Christmas Eve, New Year's Eve, Good Friday, Halloween, or St. Patrick's Day, is not listed below, then Bank of America branches will be. Bank Holiday Schedule. Our branches will be closed on the following days so our team can spend time with their families and friends. If you need to. In accordance with the uniform holiday schedule adopted by the Board of Governors of the Federal Reserve System, the following holidays are observed by the. Federal Reserve Bank of New York offices are closed on Saturdays and Sundays and the following holiday observances. Bank holiday schedule ; Holiday, , ; New Year's Day, Jan 1*, Jan 1** ; Martin Luther King, Jr. Day, Jan 17, Jan 16 ; Presidents' Day, Feb 21, Feb Holiday Hours ; January 15, , Monday, Birthday of Martin Luther King, Jr. All branches will be closed. The Customer Banking Center will be open from You will be notified if a hold is placed on any deposited funds. Transfers. Transfer funds between your Bank of America accounts or to other Bank of America. Bank will remain open until pm on the preceding holiday eve. Follow us. Routing Number: Hawaii: Guam: CNMI: BANK HOLIDAYS. Holiday Schedule. Martin Luther King, Jr. Day | Monday, January 15, Holiday Schedules. The following is the standard holiday schedule for the Federal Reserve System. Please click on a holiday date to view service change. What is the bank's holiday schedule in ? Bank of America offices and financial centers will be closed in observance of the following holidays: New. TD Bank stores are closed on the following federal holidays in Our supermarket stores follow the same holiday schedule as traditional TD stores. Below is the holiday schedule observed by the Federal Reserve System. Federal Reserve Holidays. Holiday, Date. New Year's Day, Monday, January 1. Martin. Schedule an appointmentSchedule Monday Holiday Hours Closed. Tuesday AM - PM. Wednesday AM - PM. Thursday AM - PM. Friday The following days in the year are legal holiday observances on which all banking institutions may be closed. To make an appointment to access your safe deposit box during regular business hours, email us your full name, address and phone number at: safebox@. Holiday Closing Schedule · New Year's Day · Martin Luther King Jr. Day · Presidents Day · Good Friday · Memorial Day · Juneteenth · Independence Day · Labor Day. What is the bank's holiday schedule in ? Bank of America offices and financial centers will be closed in observance of the following holidays: New. Bank Holiday Schedule · New Year's Day - Monday, January 1, · Martin Luther King, Jr. · Presidents' Day - Monday, February 19, · Memorial Day - Monday.