romacentrarterome.site Learn

Learn

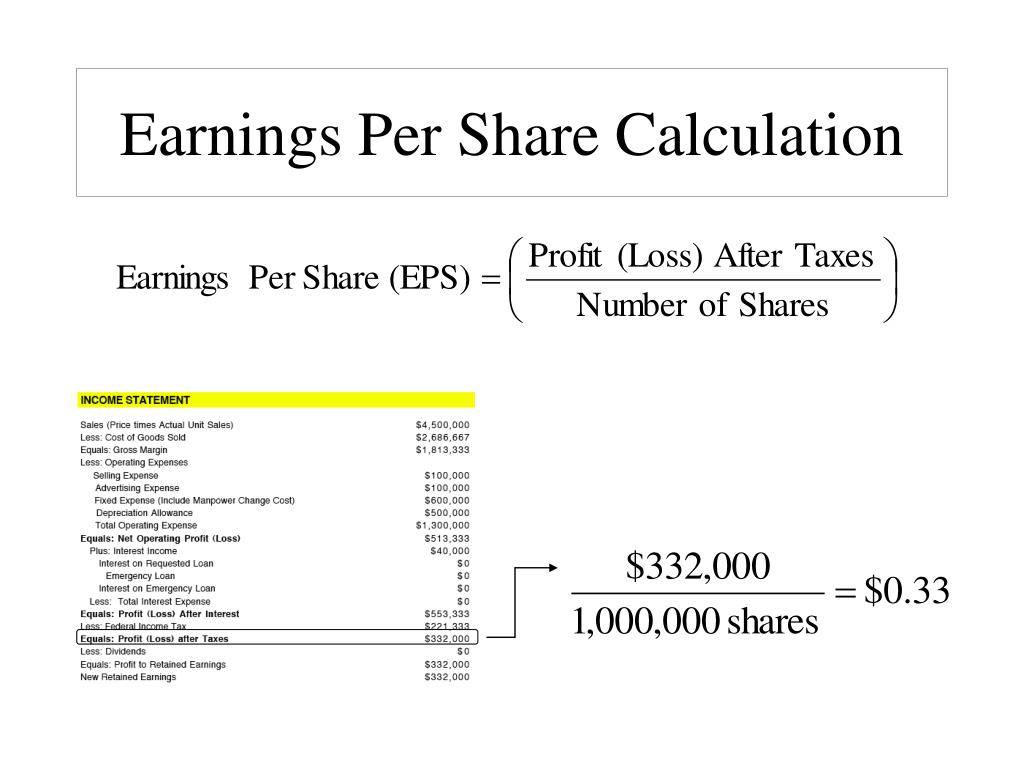

How Is Earnings Per Share Calculated

The calculation of basic EPS is straightforward for entities with simple capital structures. Basic EPS equals net income or loss divided by the weighted-average. Calculating Basic EPS · Calculate the earnings available to common stockholders: $, – $30, = $, · Calculate the weighted average number of common. EPS is a financial ratio, which divides net earnings available to common shareholders by the average outstanding shares over a certain period of time. Earnings per share (EPS) is a financial ratio calculated by dividing a company's net income by the number of outstanding shares. It's crucial as it reflects a. It is calculated by dividing the company's net income by the number of outstanding shares. EPS is an important indicator for investors as it helps them assess a. Earnings per share is the profit a company earns for each of its outstanding common shares. Both the balance sheet and income statement are needed to calculate. To calculate a company's earnings per share, you would first need to calculate its net profit by taking net income and subtracting any dividend payments. Then. It is calculated by dividing the company's net income with its total number of outstanding shares. It is a tool that market participants use frequently to gauge. Earnings per share (EPS) is a ratio that measures a company's ability to generate income for shareholders. The calculation of basic EPS is straightforward for entities with simple capital structures. Basic EPS equals net income or loss divided by the weighted-average. Calculating Basic EPS · Calculate the earnings available to common stockholders: $, – $30, = $, · Calculate the weighted average number of common. EPS is a financial ratio, which divides net earnings available to common shareholders by the average outstanding shares over a certain period of time. Earnings per share (EPS) is a financial ratio calculated by dividing a company's net income by the number of outstanding shares. It's crucial as it reflects a. It is calculated by dividing the company's net income by the number of outstanding shares. EPS is an important indicator for investors as it helps them assess a. Earnings per share is the profit a company earns for each of its outstanding common shares. Both the balance sheet and income statement are needed to calculate. To calculate a company's earnings per share, you would first need to calculate its net profit by taking net income and subtracting any dividend payments. Then. It is calculated by dividing the company's net income with its total number of outstanding shares. It is a tool that market participants use frequently to gauge. Earnings per share (EPS) is a ratio that measures a company's ability to generate income for shareholders.

Earnings per common share (EPS) is a measure of profitability that shows how much of a company's profit is assigned to each of its common shares. Example #1 · EPS formula = (Net Income – Preferred Dividends) / Weighted Average Number of Common Shares · Or. EPS formula = ($, – $30,) / 70, · Or. In its basic form, the calculation is net income − preferred stock dividends divided by number of shares of common stock outstanding. Or the formula: net income. A robust EPS can make a stock shine, signaling the company's knack for yielding more profits per share. Calculated by dividing the stock price by its EPS, the P. Earnings per share or EPS is calculated as a company's earnings – which do not account for the distribution of dividends — divided by the outstanding shares. To calculate EPS, you need to understand the calculation formula listed below. EPS = (net income – dividends on preferred stock) / average outstanding common. Earnings Per Share (EPS) is Total net profits divided by the It is also a major component used to calculate the price-to-earnings valuation ratio. How to calculate earnings per share Where: Net profit is revenue minus expenses and taxes. Dividends on preferred shares is money paid to a special class of. Earnings per share (EPS) is a measure of a company's profitability, calculated by dividing quarterly or annual income (minus dividends) by the number of. EPS Calculation: Basic Earnings-per-Share As you can see, calculating basic Earnings Per Share is easy: If a company with 1, shares earns $10,, its EPS. A company's EPS is determined by dividing its net profit by the number of common shares it has outstanding. The higher the EPS, the more money a company has. Earnings per share is a profitability ratio that determines the net earnings of each share of stock in a company outstanding at the end of a given year. The EPS figure is determined by dividing the company's net profit by its outstanding shares of common stock. However, it is considered the higher the EPS number. A robust EPS can make a stock shine, signaling the company's knack for yielding more profits per share. Calculated by dividing the stock price by its EPS, the P. Because EPS is only determined for common stock, any preferred stock dividends must be removed from net income as a preliminary step in carrying out this. For instance, to calculate the current EPS, the dividends on cumulative preferred stocks for the current period are subtracted from the net income. The step is. What are Earnings Per Share (EPS) · EPS = (Net income - Preferred dividends) / Average outstanding shares · Reported EPS = (Net Income - Preferred Dividends) /. EPS is known as a financial ratio that divides net earnings to common shareholders by the average outstanding shares over a period. Earnings per share: this is a company's net profit divided by outstanding common stock. Being the most cited metric by financial media when analyzing earnings. Earning Per Share (EPS), is a financial ratio used to measure a company's profitability. It calculates the amount of net income generated per share of.

Women Loan Scheme

Subsidy for special category women and for general category women is 30% or maximum of Rs,/-. With EDP training to selected beneficiaries. Eligibility. The Nari Shakti Scheme is for all the women who own and manage MSMEs engaged in manufacture and production Corporate-People-Discussing Corporate Loans Loan. Ministry of Finance. Department of Financial Services. Loans up to Rs 10 lakh are provided to women entrepreneurs, without any collateral, and with low interest. To bridge this gap Kinara Capital offers special collateral-free loans for women under the HerVikas scheme. The loan scheme is reserved for women entrepreneurs. Mudra loan for women: Pradhan Mantri Mudra Yojana scheme for women is designed by the government for aspiring women entrepreneurs. Women can avail a micro. The Nari Shakti Scheme is for all the women who own and manage MSMEs engaged in manufacture and production Corporate-People-Discussing Corporate Loans Loan. The objective of the Stand-Up India scheme is to facilitate bank loans between 10 lakh and 1 Crore to at least one Scheduled Caste (SC) or Scheduled Tribe (ST). Here is the list of top 5 business loan schemes that will help them get the required funding for themselves. Scheme Summary/key features: TREAD Scheme aims at the economic empowerment of women. As per this scheme, the government grants up to 30% of the total project. Subsidy for special category women and for general category women is 30% or maximum of Rs,/-. With EDP training to selected beneficiaries. Eligibility. The Nari Shakti Scheme is for all the women who own and manage MSMEs engaged in manufacture and production Corporate-People-Discussing Corporate Loans Loan. Ministry of Finance. Department of Financial Services. Loans up to Rs 10 lakh are provided to women entrepreneurs, without any collateral, and with low interest. To bridge this gap Kinara Capital offers special collateral-free loans for women under the HerVikas scheme. The loan scheme is reserved for women entrepreneurs. Mudra loan for women: Pradhan Mantri Mudra Yojana scheme for women is designed by the government for aspiring women entrepreneurs. Women can avail a micro. The Nari Shakti Scheme is for all the women who own and manage MSMEs engaged in manufacture and production Corporate-People-Discussing Corporate Loans Loan. The objective of the Stand-Up India scheme is to facilitate bank loans between 10 lakh and 1 Crore to at least one Scheduled Caste (SC) or Scheduled Tribe (ST). Here is the list of top 5 business loan schemes that will help them get the required funding for themselves. Scheme Summary/key features: TREAD Scheme aims at the economic empowerment of women. As per this scheme, the government grants up to 30% of the total project.

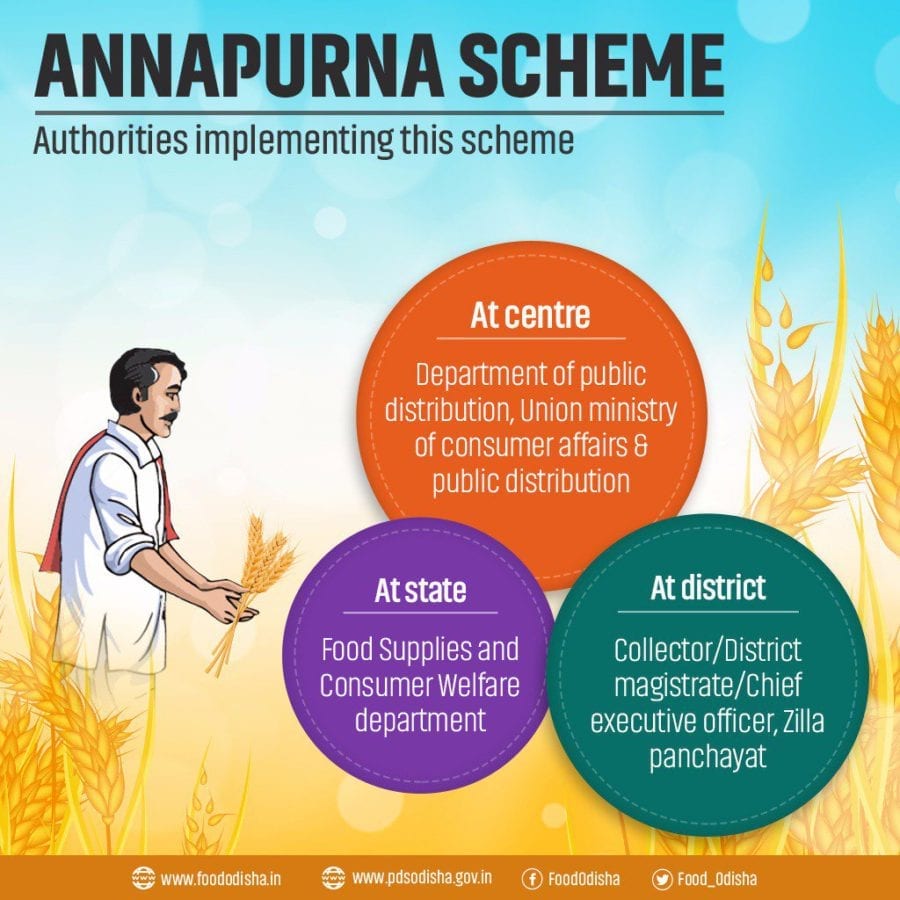

Top 5 Government Schemes That Have Helped Budding Women Entrepreneurs In India · Annapurna Scheme · Bhartiya Mahila Bank Business Loan · Mudra Yojana Scheme for. A Business Loan for Women Entrepreneurs is a specially curated loan for businesses run by women to meet the rising business demands or to cover a variety of. The maximum interest rebate under the Scheme is 9%, however interest rebate under Category A+B+C is capped to maximum of 7% p.a and 2% p.a interest rebate is. SC/ST and/or woman entrepreneurs, above 18 years of age. · Loans under the scheme is available for only green field project. · In case of non-individual. Interest-Free Loans: Under the scheme, women entrepreneurs can avail of interest-free loans of up to Rs. 1 lakh to start or expand their businesses. The loans. Under the scheme, banks and DFIs will be required to provide financing facilities to women entrepreneurs to meet credit needs of their businesses. Under the. Thanks to the contributions of our donors, we partner with local banks to offer dedicated financing to help women entrepreneurs access the finance they need to. Dena Shakti Scheme. This scheme provides loans up to Rs 20 lakh for women entrepreneurs in agriculture, manufacturing, micro-credit, retail stores, or similar. Introducing the Refinance and Credit Guarantee Scheme for Women Entrepreneurs, an initiative that provides easy access to financing for women-led businesses. Women-owned businesses · Native American-owned businesses · Veteran-owned Military reservist loan · Hawaii wildfires · Surety Bonds icon. Surety bonds. Udyogini is an innovative scheme to assist women in gaining self-reliance and economic independence through self-employment, mainly through trade and the. State Bank of Pakistan has introduced a refinance scheme* for women titled “Refinance & Credit Guarantee Scheme for Women Entrepreneurs (IRCGS-WE)”. Women Entrepreneur Loan Scheme 90% of cost of project up to a maximum of Rs , or Rs 1M. Women Entrepreneurs or companies with women among majority. This scheme makes financial assistance easily accessible to women entrepreneurs who are seeking flexible financing options. You can get loan amounts ranging. The Annapurna scheme is an incredible loan program exclusively available to women. It provides quick and easy access to credit at low interest rates. The. Financing shall be available to Women borrowers only. · Financing under the scheme shall be provided for setting up of new business enterprise or for expansion. $ B in SME loans to women-owned enterprises. At a Glance. As of July , IFC's Banking on Women business has mobilized and invested US. Udyogini Scheme: Encouraging Women to take loans from banks and other financial institutions to take up income generation activities listed by KSWDC or other. Introducing the Refinance and Credit Guarantee Scheme for Women Entrepreneurs, an initiative that provides easy access to financing for women-led businesses. Maximum Loan Limit: NSFDC provides loans up to 90% of the Project Cost with maximum amount of Rs lakhs · Rate of Interest: NSFDC shall charge interest @ 2%.